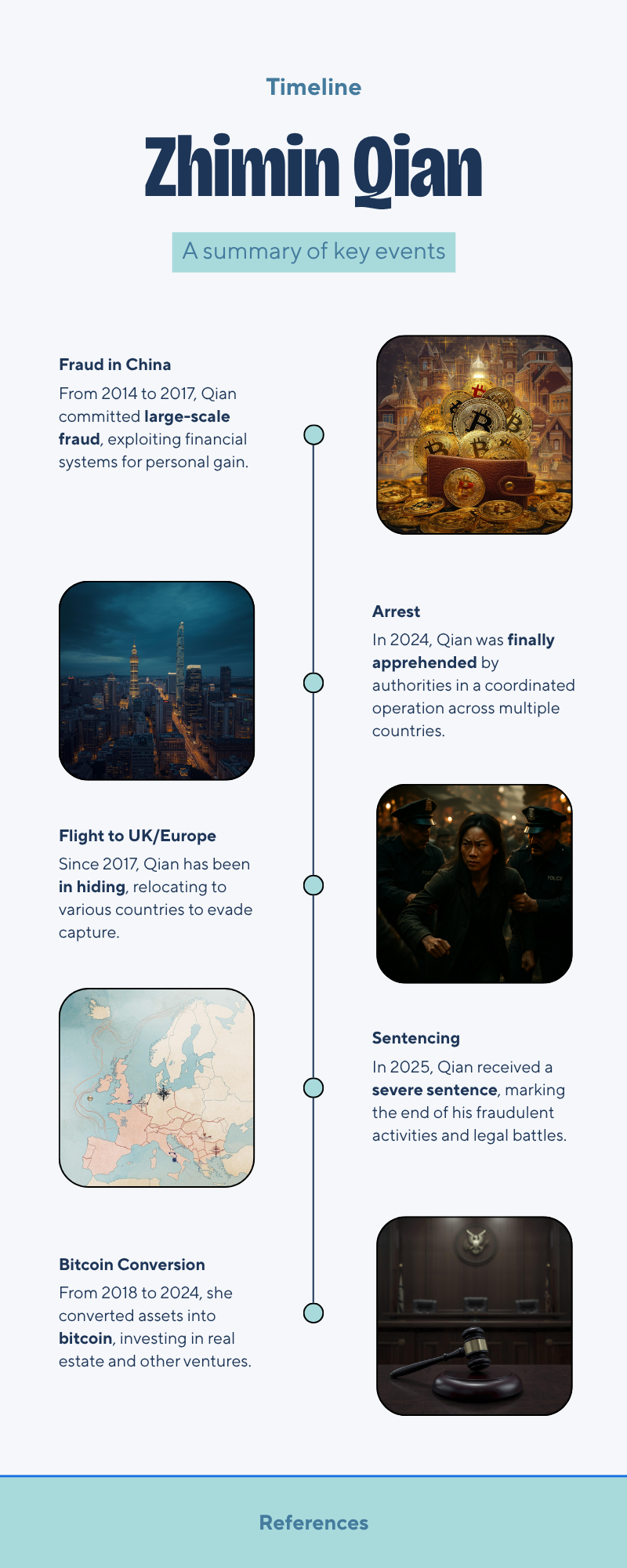

£5 Billion + Crypto Fraud: Chinese Woman Jailed for UK’s Largest-Ever Bitcoin Seizure

On 11 November 2025, a 47-year-old Chinese national, Zhimin Qian, was sentenced to 11 years and eight months in prison by Southwark Crown Court for laundering the profits of a multi-billion-pound investment scam using the crypto platform Bitcoin. The case brought about the UK’s largest-ever cryptocurrency confiscation — more than 61,000 bitcoins, now worth around £5 billion — and elevates a sharp light on the growing connection of fraud, digital assets and cross-border crime.

Background

In the years between 2014 and 2017, Qian and the business she ran supposedly defrauded over 128,000 victims in China of approximately 40 billion renminbi (~£4.3 billion) through a high-return investment scheme pretty much a Ponzi scheme.

She then fled China in 2017, coming to the UK under a fake identity and began converting the profits into bitcoin and other assets. In the UK, detectives found out that she used luxury properties, jewellery purchases and large bitcoin transfers in her laundering process.

Picture of Zhimin Qian

Key Developments

The Met Police investigation traced devices and wallets containing over 61,000 bitcoins, representing the largest confirmed cryptocurrency seizure in UK history.

Qian’s UK accomplice, Seng Hok Ling (47), was also now imprisoned — sentenced to four years and eleven months for moving criminal property.

Civil recovery proceedings are now started to control how much of the bitcoin and other assets can be returned to the defrauded victims — including many in China who unfortunatly lost life savings.

The case shows that UK authorities are stepping up action against crypto-related fraud and money laundering, making it clear that digital assets are not a safe place to hide criminal cash.

Implications / Impact

For individual investors, especially those new to digital assets or pitched high-yield schemes understand this, the case is a blunt reminder: if an investment plan promises abnormally high returns and uses cryptocurrency as a instrument, the risk of fraud is very high.

For businesses in the fintech and crypto sector, this case emphasises that regulatory authorities are increasing examining of how cryptocurrencies can be used to launder money and how asset tracing can succeed despite claims of anonymity.

For younger online users, the story highlights that digital currencies are not immune from traditional financial crime and that what appears to be “just crypto” can mask decorative fraud networks.

At societal level, the case stresses the need for international cooperation in financial crime enforcement — the fraud crossed China, Europe and the UK — and highlights how digital assets are becoming a conventional tool for organised crime.

Expert Quotes or Data

According to Detective Sergeant Isabella Grotto, lead investigator in the case:

“Money laundering enables and supports serious criminality across our communities, and organised crime groups increasingly use cryptocurrency to move, hide and invest the proceeds of serious crime.”

Financial crime analysts acknowledge that the transparency of blockchains gives detectives a tool to trace prohibited funds — although criminals still attempt to evade using mixing services, cross-border transfers and fake identities.

Response & Next Steps

Authorities advise the following actions:

Report suspicious investments: People need to practice & apply due diligence! Doing extensive research on any investment opportunities is pivotal.

Companies should conduct enhanced due-diligence on crypto-asset flows, especially when funds originate from abroad or are converted rapidly into luxury goods or property.

Educators and students: Educational sectors need to start preparing students in schools and universities the risks of “too good to be true” crypto schemes or any other investment schemes, and how digital-asset fraud affects real psychological and financial well-being.

Victim-assistance schemes: The UK case now involves potential compensation for overseas victims; victims should register their claim and retain evidence of investment losses and communications.

Image Generated from Canva

Stay alert: if a crypto investment promises unrealistic returns, ask questions, verify credentials, and never assume “blockchain” equals safe.